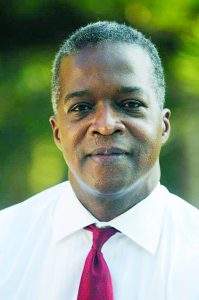

Tromp loses court battle for his salary

WILLEMSTAD – Dr. Emsley Tromp made a failed attempt to recoup his salary for the months of December and January from the Central Bank of Curacao and St. Maarten where he worked for more than 25 years as its president. The Court in First Instance denied Tromp’s request that the bank pay his salary over the months of December and January and his 2017 year-end bonus.

WILLEMSTAD – Dr. Emsley Tromp made a failed attempt to recoup his salary for the months of December and January from the Central Bank of Curacao and St. Maarten where he worked for more than 25 years as its president. The Court in First Instance denied Tromp’s request that the bank pay his salary over the months of December and January and his 2017 year-end bonus.

Tromp received a gross monthly salary of 59,915 guilders ($33,472). In 2016 he started making expenses for legal assistance and fiscal advice because of a criminal investigation into his private finances and because the national security service refused to issue a statement of no objection about his behavior.

The bank paid these expenditures, totaling almost 283,500 guilders ($158,380) up to July 1, 2017.

The Central Bank’s interim president Jerry Hasselmeyer wrote on June 30, 2017, to the bank’s department of financial affairs that it would advance these expenditures to Tromp with the understanding that parties would discuss after the conclusion of the trial whether these expenses were made for the benefit of the bank or for Tromp’s private benefit.

Tromp was fired by national decree of the governors of Curacao and St. Maarten per October 17, 2017. The bank reported to Tromp that his contract would end on November 1, but that the bank would pay his monthly salary for another four months; this is equal to the legal notice period.

The bank paid Tromp’s November-salary, but in December things changed. The bank ‘paid’ the remaining months as a lump sum, included a year-end bonus of 12,805 guilders ($7,154) but it then settled those amounts against “the outstanding amount with the bank.” The result was that Tromp did not receive a penny in December.

The articles of incorporation state that the bank will compensate legal costs for its staff for procedures that result from the execution of their jobs. The court ruled that the investigation against Tromp is about tax fraud with his private finances. Costs for legal assistance related to the negative advice from the national security service do not automatically qualify as costs related to the execution of one’s function, the court ruling furthermore states.

The court furthermore dismissed the promise made in Hasselmeyer’s letter; first of all because the letter was not addressed to Tromp but more importantly because that promise exceeded a value of 250,000 guilders. Above that amount, decisions require approval from the supervisory board.

The court concluded that it is not plausible that the Central Bank is liable for Tromp’s legal expenditures. “The bank has a claim on Tromp for the repayment of the advanced costs.”

While Tromp argued that his contracts had not yet ended (because he was still receiving his salary), the court ruled differently: the contract ended per November 1, as stipulated in a letter from the bank to Tromp dated October 27, 2017. Because of this, the bank was authorized to settle the outstanding amount against Tromp’s salary, the court ruled.

The court sentenced Tromp to pay the costs of the procedure – 1,500 guilders ($838).