Ansary puts ownership Mullet Bay into question

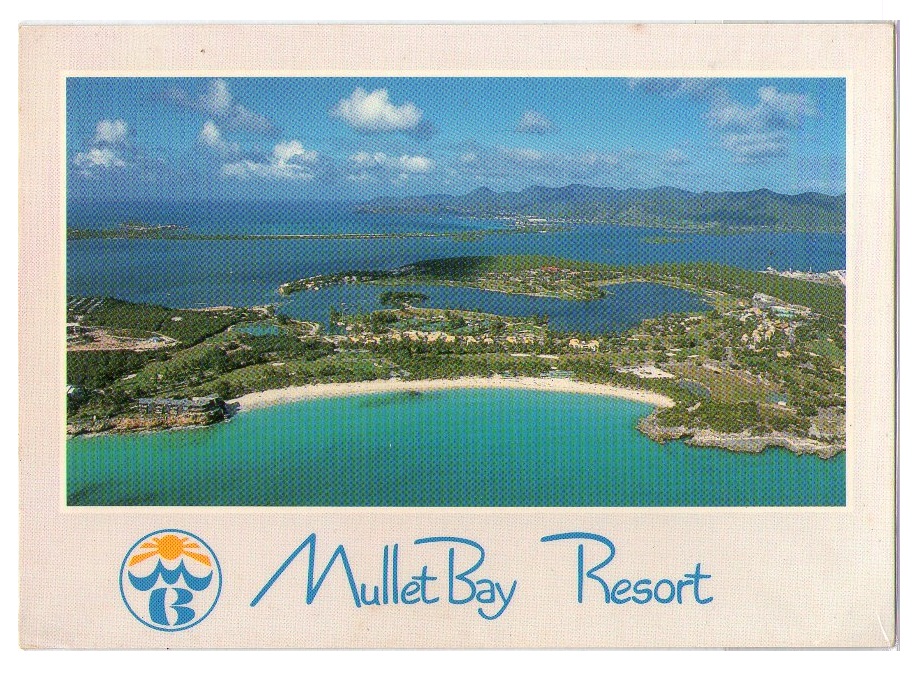

PHILIPSBURG — Who owns Sun Resorts and, by extension, Mullet Bay? That question was the cornerstone of a dispute in court between Hushang Ansary and the Central Bank of Curacao and St. Maarten. Mullet Bay is an asset of insurance company ENNIA; since 2018 the insurer is under management by the Central Bank.

Hushang Ansary acquired Ennia in 2006 and it did not take long before Mullet Bay started playing a major role in the financial wellbeing of the insurance company. Ansary, the majority shareholder and director of Sun Resorts, transferred shares Sun Resort held in Mullet Bay to Ennia. The shares were valued at $460 million and the Mullet Bay value represented more than 40 percent of Ennia’s assets. Later, a new appraisal commissioned by the Central Bank put the realistic value of Mullet Bay at around $50 million.

The Central Bank wants to sell the property to infuse Ennia with much needed capital, but last week the attorney for Ansary, Achim Henriquez, threw a spanner in the works by claiming that ECI (Ennia Caribe Investment) has not presented any proof that it is the legal owner of the Sun Resorts shares.

The attorney referred to the so-called blocking-regulation which limits the possibilities to transfer shares to a new owner. There are two options: offer and approval.

The offer-option requires that shares must first be offered for sale to other shareholders, before they can be sold to a third party. The approval option requires that all shareholders give their permission for the transfer of the shares. If these rules are not followed, the transfer of shares could become void.

History of the companies led by Ansary show that the Iranian-American businessman most of the time did what he wanted without paying much attention to those around him.

Here is a typical Ansary-quote from an interview with Telecuracao on January13, 2019: “On July 4, when Ennia was taken over by the Central Bank, it had never been this prosperous, this liquid, this effectively functioning and this profitable in its 70-year history.”

The reality: At that time Ennia had a solvency deficit of 700 million guilders ($391 million).

Hanging on to Mullet Bay as an asset for Ennia was not such a bright idea either, if you follow the opinion Buck Consultants expressed in a memorandum in 2016: “Holding land to cover insurance liabilities creates a loss of 20 million guilders ($6.2 million) per year.”

By October 2010, Ennia held 93.3 percent of the shares in Sun Resorts and the value of Mullet Bay represented 55 percent of the insurer’s total assets.

The court now has to decide whether Ansary’s attorney has a point. It would be quite a feat, given that Mullet Bay has been on the Ennia-books for twelve years and nobody ever questioned whether the company really held the shares in Sun Resorts.

For Ansary, the clock is ticking. Born in Ahvaz, Teheran, in 1926, he has truly reached the twilight zone of his life at age 96. The fight with the Central Bank over Mullet Bay could very well be his last one.

Update: Ansary loses legal fight for Mullet Bay

###

Related articles:

Column – De Golden Key-zwendel

Article Antilliaans Dagblad: Strijd om SunResorts