St. Maarten needs massive financial support

Central Bank interim-President Jardim sounds the alarm:

Central Bank interim-President Jardim sounds the alarm:

St. Maarten needs humongous financial support

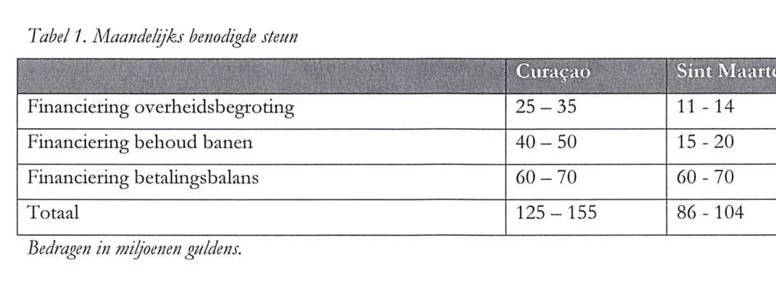

PHILIPSBURG – St. Maarten’s government needs between 86 and 104 million guilders ($48 to $58.1 million) per month to stay afloat for the duration of the corona-virus crisis. José Jardim, the interim president of the Central Bank of Curacao and St. Maarten released these numbers during a press conference in Willemstad. The balance of payment for the monetary union requires another 60 to 70 million ($33.5 to $39.1 million) per month.

Jardim made this dramatic announcement during a press conference about the Solidarity Package for Curacao hosted by the government of Curacao in Willemstad, where Prime Minister Rhuggenaath stated, according to a report in the Antilliaans Dagblad, that the crisis will probably last up to six months. Rhuggenaath expects the gross domestic product for Curacao to drop between 15 and 20 percent.

Curacao and St. Maarten need huge financial injections to support their national budgets.

In a worst case scenario (if the corona-crisis lasts six months) St. Maarten’s economy could shrink by a potentially devastating 29.2 percent according to Jardim. For St. Maarten’s tourism industry, everything hinges on how fast the borders will reopen for cruise and stay-over tourism.

If the borders reopen after a month and the economy recovers quickly, economic growth will decrease to a level of 0.8 percent. If they remain closed for half a year, the economy could shrink by 15 percent, though that number depends heavily on how fast it recovers. In case of a gradual recovery, Jardim said, the economy could shrink between 5.7 and 29.2 percent.

Jardim pointed out what everybody knows: Curacao and St. Maarten do not have the instruments or the resources to bring this crisis under control. He referred to article 36 of the Kingdom Charter; it states that the Netherlands, Aruba, Curacao and St. Maarten assist each other.

Curacao will also suffer dearly from the corona-crisis, but because its economy is more diversified than that of St. Maarten, the numbers are less dramatic. With a quick recovery of business activities after the reopening of the borders Jardim projects that the islands economy will shrink between 4.5 to14.2 percent. A gradual recovery will result in a downturn between 8.8 and 19.4 percent.

In its analysis of the situation, the Antilliaans Dagblad writes that the corona-crisis will impact St. Maarten much heavier than Hurricane Irma.

“Irma caused a cumulative economic downturn of 11 percent. Under the current circumstances cruise tourism cannot help mitigating the damages and therefore the additional annual effect of the corona-crisis on the economy will be much larger,” the newspaper writes.

The AD warns that a lengthy reduction in the global food production will result in scarcity and that this in turn will result in higher prices. People will not have sufficient income to pay for their basic necessities.

Dutch emergency support is an absolute must, the AD points out. At the same time, it wonders how The Hague will react to the need for supporting the autonomous Caribbean countries. Curacao, Aruba and St. Maarten almost don’t have a penny to their name anymore. Aruba has built up humongous debts while Curacao has let its economy tank and failed to put labor market and civil service reforms in place, while St. Maarten has allowed corruption to flourish. This basically sums up the thinking of quite some politicians in The Hague.

“Money troubles themselves spread like a virus.” – Dr. Emsley D. Tromp

In an op-ed in the Antilliaans Dagblad, former Central Bank President Dr. Emsley Tromp sends a rather ominous message, projecting an economic downturn for the monetary union of 15 to 25 percent. But there is worse: “No society can safeguard public health for long at the cost of its overall economic health,” Tromp writes.

In an op-ed in the Antilliaans Dagblad, former Central Bank President Dr. Emsley Tromp sends a rather ominous message, projecting an economic downturn for the monetary union of 15 to 25 percent. But there is worse: “No society can safeguard public health for long at the cost of its overall economic health,” Tromp writes.

On the other hand, Tromp notes, “Now is not the time to carve up businesses in bankruptcy court.” However: “The issue is not stimulus. Stimulus will do no good and will be counterproductive. You cannot shop or travel when shops and airlines are closed.”

According to Tromp any domestically financed rescue package “will bring undue pressure to bear on the already strained foreign exchange reserves, hence undermining the stability of the peg.”

The peg is the constant value of the Antillean guilders versus the US dollar.

Tromp concludes that the financial support of the kingdom government is “the appropriate policy response and should be similar to the response adopted in the aftermath of (Hurricane) Irma – adjusted for the bureaucratic tangles that led to the ineffectiveness of the (Trust) Fund.”

Tromp advises the governments of Curacao and St. Maarten to establish the desired rescue packages “upward.” This is because the corona-pandemic had rendered the current government programs unattainable. Furthermore, the former Central Bank president notes: “It is important to remember that the response to this pandemic will not eliminate the economic ills we were confronting before the crisis.”

The Central Bank itself also needs a “precautionary line of credit because of the growing deficit on the current account of the balance of payments, dwindling foreign exchange reserves and a vanishing tourism sector. The current peg is bound to come under pressure if this pandemic lasts into the summer.”

###

Related links:

Report in Antilliaans Dagblad: “750 to 930 million in financial support needed”

Analysis in Antilliaans Dagblad: “Let realism prevail”

Opinion piece: “A nightmare scenario“