Will St. Maarten finally leave the monetary union?

PHILIPSBURG — The Social Economic Council advised the government more than ten years ago, in February 2013 to leave the monetary union with Curacao as soon as possible.

Politicians may have read the advice, or maybe they did not but the result was that they did nothing at all with it. The Council’s advice to introduce dollarization also fell on deaf ears.

Even before that advice was published it was clear that St. Maarten was not happy with the Central Bank of Curacao and Sint Maarten (CBCS) and the associated monetary union. In April 2012, then Minister of Finance Hiro Shigemoto said: “It does not work so it is better to stop with it.” St. Maarten’s Council of Ministers had reached an agreement in principle, the minister told the Dutch press agency ANP. “Our decision is firm.”

But twelve years later St. Maarten is still in a monetary union with Curacao. The Social Economic Council pointed out in its 2013-advice why this is a bad idea: “The deteriorating position of the current account is wholly due to Curacao and this could result in a crisis on the balance of payments.” The Council also warned for a sudden devaluation of the Antillean guilder and inflation for the whole of the monetary union.

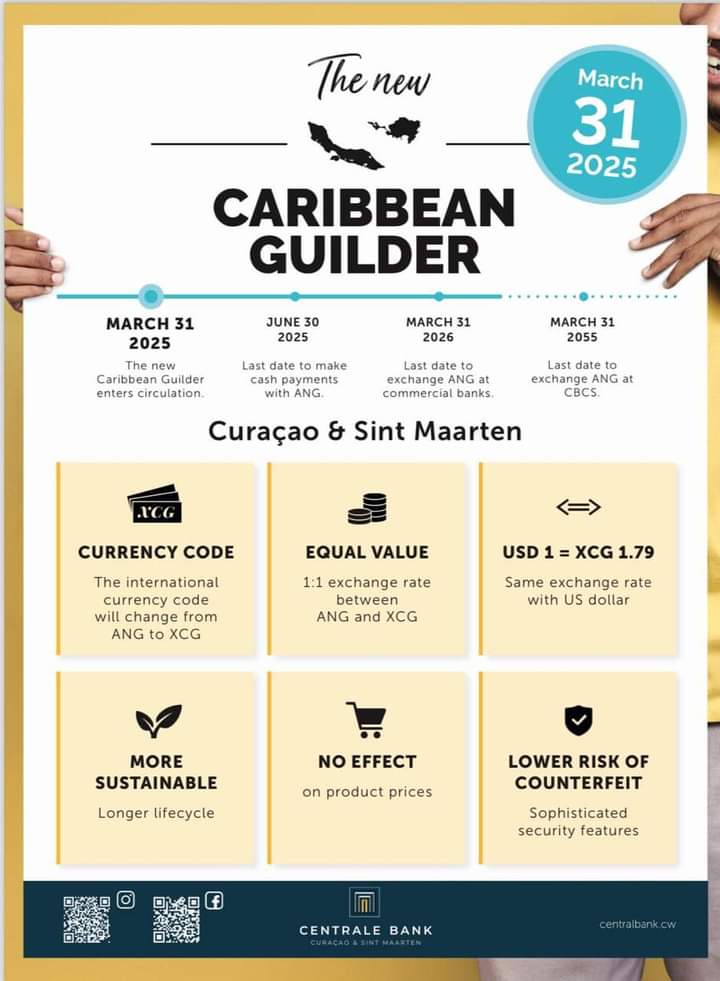

When St. Maarten obtained its autonomous status on October 10, 2010, it planned to secede from Curacao. That did not happen. St Maarten stepped into the monetary union and accepted the continued existence of the Antillean guilder. The CBCS baffled both countries with the announcement that it would launch the XCG, the new Caribbean guilder, in 2025 without asking governments or parliaments for any input.

Another sore point is the announcement – in January – that The Bank intends to strengthen its financial position by selling 30 percent of its gold reserves. The Bank wants to invest the proceeds of this sale in American bonds.

Currently the official reserves of the Central Bank consist of bonds (52%), working capital (13%) and gold (34%). After the sale these percentages will become 62%, 14% and 24% respectively.

Critics of the gold-sale say that it would have been better to borrow against the gold reserves and use the funds for the purchase of the U.S. treasury bills and notes and use the gold as collateral for the loan.

Right now, the call for secession from the monetary union is becoming stronger. Whether St. Maarten really will leave the union remains, given the history of this topic, to be seen.

###

Related articles:

Central Bank launches Caribbean guilder in March 2025

Central Bank announces introduction of Caribbean Guilder in 2021

The Golden Guilder