Doing business in St. Maarten: bottlenecks and solutions (part 3)

3. Paying taxes

PHILIPSBURG — Establishing a business in St. Maarten is an at times an expensive road littered with stumbling blocks. The Ministry of Home Affairs and Kingdom Relations and the Ministry of Economic Affairs, Tourism, Transport and Telecommunication commissioned a report to assess the local business climate, identify bottlenecks and recommend solutions. The report is produced by the Foundation Economic Research (SEO), the Economic Bureau Amsterdam (EBA) and Tackling Law.

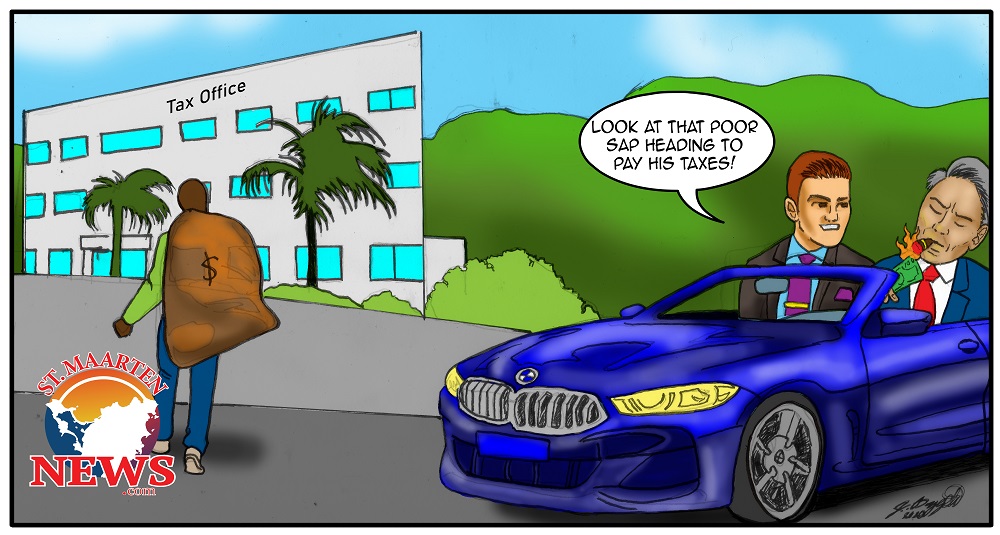

In this third episode in a series of articles based on the report we take a look at another issue that causes many an entrepreneur nightmares: paying taxes.

St. Maarten’s tax system is complex and payments are mostly done in cash, the report notes. Here are some figures that support this notion. In 2021 the average number of monthly payments to the tax office was 19,000; 19% was done online, 20 percent through checks and the remaining 61 percent in cash. This is already a slight improvement compared to 2019, when there were on average 17,000 monthly payments, of which 6 percent was done online, 24 percent through checks and 70 percent in cash.

The researchers found that there is a lack of digitalization, that the tax office is understaffed and that the tax compliance rate is low. They also note that the turnover tax and the absence of import taxes stimulate vertical integration. This in turn reduces the possibility for new companies to enter the market. It also stimulates direct parallel import, which hurts locally established businesses. Lastly, the turnover tax raises costs for companies that trade cross-border, because it is complicated for exporters to obtain an exemption for this tax.

The tax burden in St. Maarten is high and this makes the country less competitive compared to other regions. The corporate profit tax is 34.5 percent, turnover tax 5 percent and progressive income tax ranges from 12.5 to 47.5 percent. Then there is a 5 percent room tax and a 4 percent real estate transfer tax. Two taxes are not levied even though the legislation for them is in place: the dividend tax and the real estate property tax (0.3 percent). The property tax is not levied because St. Maarten lacks a well-functioning real estate value system.

That the tax burden is high is one thing; paying taxes represents an additional pain in the neck. An example is the turnover tax. Companies have to declare this tax monthly and they can make the payment online. But they have to show proof of payment physically and they also have to present the turnover tax-declaration and the payment form in person at the tax office, where waiting times can run op to one hour.

The tax office is not always on the ball either. Entrepreneurs sometimes receive their tax bills so late that the statue of limitations (5 years) has already expired; in those cases the government cannot claim taxes anymore. On the other hand this has inspired entrepreneurs not to pay taxes at all, hoping that their tax bill will arrive past the expiration date.

That turnover taxes raise the cost of doing business, not to mention consumer prices, is a well-known fact. Every step in the supply chain adds another 5 percent to the price of goods and services. This also creates an incentive for direct parallel import by companies and consumers: by ordering directly from abroad they do not pay turnover tax because they do not have to pay import duties.

The International Monetary Fund has therefore proposed introducing a 7.5 percent import tax on purchases from foreign supplies directly to consumers. While this would obviously increase consumer prices, the system could also generate more homegrown economic activity because locally established businesses would not have to pay the import tax; they are only subject to the 5 percent turnover tax.

Substantial changes to the turnover tax-system will not be possible without an overhaul of the existing tax system, the report noted. This is because turnover tax represents almost one third of the country’s annual revenue.

What are then the solutions to make life a bit easier for the private sector? The report offers clear recommendations: digitalize the front- and the back office of the tax inspectorate, thus enabling online payments. “All physical interaction should be removed from the process. Digitalizing the tax office lowers the burden for entrepreneurs and for the government significantly. It also provides a clear overview of tax revenue and the tax burden.”

The costs for these changes are expected to be high, because the transition needs a coordinator. Preparation costs will also be high, while the authors foresee that feasibility will be low: “It is complex because the history and the backlog of tax application must be transferred to the new system.”

Nevertheless, making the effort would still be worth it. The report labels the impact of digitalization as high. It will be timesaving for entrepreneurs, tax payers would be able to consult the system and transparency and certainty would increase.

Digitalization would be beneficial to both the government and the tax payer. Therefore, the authors do not expect strong opposition to such a project.

And while the authors label the priority for this project as high, it is not the mother of all solutions either: “This transition alone is far from sufficient to improve the business climate.”

###

Related links:

Doing business in St. Maarten: bottlenecks and solutions (part 1)

Doing business in St. Maarten: bottlenecks and solutions (part 2)

Doing business in St. Maarten: bottlenecks and solutions (part 4)

Report: Spurring Entrepreneurship in Sint Maarten

Review article SEO Economisch Onderzoek (In Dutch)

Reducing red tape improves the business climate

Minister Ottley launches training program for aspiring entrepreneurs

Minister of Finance launches corporate governance traineeship