Open Letter to the Ombudsman of Country Sint Maarten requesting an investigation into Taxes in Sint Maarten

![]()

Generally speaking the task of the Ombudsman purports among others to investigate individual complaints against government. I believe that in this instance this threshold is met. The scope of taxation affects everyone in Sint Maarten.

Differently put, I would like you to examine if the principles of good governance is adhered to by government and the way the executed policies affect the citizens.

The individuals, whose plight I wish to address in this open letter is that of my fellow citizens and particularly that of the pensioners. When the pensioners were in their productive years, they contributed widely to making Sint Maarten what it is today. The wages were meager. There were hardly any pension funds except for an APNA or a Vidanova. So presently many pensioners have to survive on an old age pension (SZV).

The SZV pension is not a livable one and often on top of that any additional income is taxed more than proportionally. Pensioners in Sint Maarten are marginalized, they are treated as a insignificant group until voting comes around. Many pensioners live like recluses, not by choice but by force. This dire outlook has taken away the quality of their remaining years. Add to this that with old age comes many health issues and more challenges to face to survive.

The Collection of Taxes is mandated through the Collection Ordinance of 1970. Article 6 of that Collection Ordinance reads as follows:

- De Ontvanger is bevoegd aan de belastingschuldige op zijn verzoek uitstel van betaling en gemakkelijke betalingsvoorwaarden te verlenen ……………. betalingsregelen te voldoen.

- Uitstel van betaling of enige andere betalingsregeling doet niet af aan het bepaalde in artikel 11.

- Voor wat betreft de winstbelasting wordt uitstel nimmer voor langer dan vier maanden verleend.

- De in de leden een en drie vermelde betalingsregelingen worden schrifetelijk verleend.

- Indien de belastingschuldige niet in staat is anders dan met buitengewoon bezwaar de belasting of de volle belasting te betalen, kan de belasting geheel of gedeeltelijk worden kwijtgecholden, doch slechts in bij eilandsbesluit houdende algemene maatregelen te bepalen gevallen en onder daarbij te stellen voorwaarden.

This Collection Ordinance is more than 50 years old. We have had successive Commissioners of Finance, Executive Councils and since 2010 various Parliaments and Ministers of Finance. It is sad to observe that 50 years on, the legislative branch has not seen it fit to write the general rules and conditions that each tax payer should meet if he or she is seeking a write off of the respective taxes. What about the principle of law? Can politicians ignore the law?

This is a serious derelict of duty by our elected officials that should not be allowed to be continued and in doing so making life harder for the few tax payers known through their CRIB number. The question then comes to mind how many old people are suffering needlessly because of this ongoing derelict of duty? How many old people have nightmares knowing that they have taxes to pay and that the Receiver is merciless?

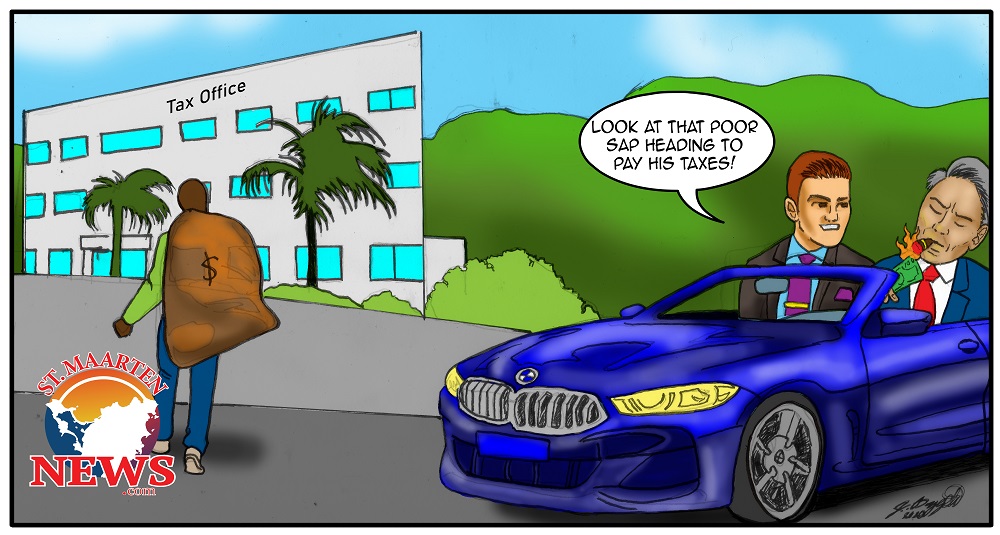

Companies and businesses that can afford a tax lawyer, regularly contest their taxes and are able to point out flaws in the assessment and in the end are better off. So Madame Ombudsman it is discriminatory abuse of power and an infringement on our human rights that the taxpayers seeking a write off of their taxes have no publication to go by from our Tax Authority on Sint Maarten, outlining how to go about having their taxes lowered based on the general measures and conditions as prescribed by the law.

No one should be above the law but when the legislative branch is underperforming it leads to unnecessary hardships in the country. Is it too much to seek accountability from our elected officials?

As outlined before the lack of clarity on whether the poor man has a reasonable expectation to be able to have his taxes written off once conditions are met, has led to a deterioration in the living standards for many people, especially the older ones. This is evident from the many soup kitchens, the need for food aid and spiraling crime.

There are many court cases that government lost because among others there was no semblance of good governance. The principles often cited by the judiciary are: the principle of due care, the principle banning abuse of power, the principle of balancing of interest, the principle of proportionality, the principle of justification, the principle of equality, the principle of legitimate expectations, the principle of law, the principle that bans randomness and the principle of fair play. Government’s performance based on these principles, related to the Collection of Taxes, is a big F and a violation of the law.

Another issue that is worth looking into is whether Country Sint Maarten as recipient of Technical Assistance has been scammed in the past. This is a legitimate question seeing that there was a revelation in an article dated May 22, 2022, that the Dutch Tax Authority for years practiced and condoned discrimination of certain taxpayers by blacklisting them. Sint Maarten was and probably still is a recipient of Technical Assistance. Was this nefarious practice part of what the technical assistants brought to the table? After all they were the experts and they would have worked from their comfort zone. In other words: How integer and transparent were the technical assistance rendered. This news in the Dutch media has caused many persons to wonder if those technical assistants, implemented those practices when dealing with the local taxpayer, especially when it came to the auctioning of movable and immovable property.

The derelict of duty and noncompliance with the law by successive governments has caused and continues to cause unnecessary hardships for the people of Sint Maarten. People are living with a millstone tied to their necks since the Collection Ordinance 1970 went into effect. In the meantime we had hurricanes Louis and Irma aftermaths to deal with followed by the Covid-19 pandemic.

Procedural law states that each and every tax payer has the inalienable rights to negotiate the best financial outcome for him or herself. Completing paragraph 5 of article 6 of the Collection Ordinance 1970, as mandated by law, would level the playing field and give more spending power and thus a better standard of living, to those who qualify for a relief in any given year. The lack of this criteria and conditions is causing a serious threshold or rather a serious barrier for the public at large and the pensioners in particular, to their general health and wellbeing since there is no money to pay those taxes or a Tax Consultant.

Madame Ombudsman you are the expert in this type of arbitration. You have resources and contacts that are not available to the common man. You are above politics. The situation described in this piece is of great importance to the average Sint Maartener. This conversation is relevant especially in view of the many conversation surrounding reparations from the Dutch pertaining to colonialism but there are no conversations about the harm inflicted on the people of Sint Maarten in denying them their legitimate expectations, that should have been laid down in paragraph 5, of article 6 of the Collection Ordinance 1970, so many years ago. The people of Sint Maarten remain hopeful that though Lady Justice is blind, that this matter will change with your attention as to why the law was not followed.

John A. Richardson

###

Related articles:

Ombudsman asked to investigate fairness of tax system

Accountant Natasha Manuela on paying taxes

Collecting more taxes does not require reform; it requires enforcement

Labor Union against pensioners paying taxes

Geerlings offers payment plan on unpaid taxes to ease the pressure on businesses

Tax reform – Profit tax

MP De Weever: “Our tax system is a bit absurd”