Small part of Mullet Bay up for sale

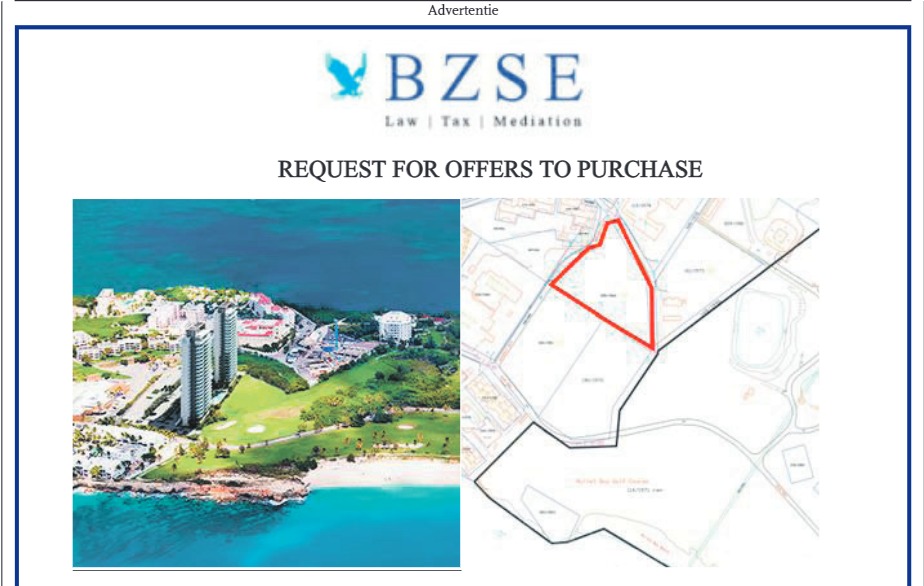

PHILIPSBURG -- The Central Bank of Curacao and St. Maarten (CBCS) has put up 11,000 square meters of Mullet Bay for sale. This appears from an ad published in the Antilliaans Dagblad on October 16.

The parcel of land is located near the American University of the Caribbean, next to the golf course in Cupecoy.

Under the headline Requests for Proposals of Purchase, Pieter Soons, an attorney at the law office of BZSE, details the requirements for interested parties.

Offers have to be submitted in writing, accompanied, among other requirements, by a source of funds declaration. Legal entities have to submit a chamber of commerce extract with copies of passports of statutory directors and ultimate beneficial owners.

The owners of Mullet Bay is Sun Resorts, a company established by Hushang Ansary. Currently, this company is under control of the CBCS that appointed Geomaly Martes, a former director of the government accountants bureau SOAB in Curacao, and former notary Mike Alexander as its managers.

The Mullet Bay property measures 67.7 hectare (677,000 square meters). Forty hectare is in use as a golf course. The parcel that is now up for sale represents 1.6 percent of the total.

It is unclear whether Sun Resorts or the Central Bank is the party that is putting part of the property on the market. Attorney Soons writes in the ad: “Our client explicitly and irrevocably reserves the right to cancel this process at any point (….) or to not consider any specific offer made, for any reason or for no reason at all.”

This suggests that the attempt at selling part of Mullet Bay is an exercise to get a feel for its true market value.

Mullet Bay plays a big part in the drama at insurance company ENNIA. The property has been heavily overvalued and put as an asset on Ennia’s balance sheet to make the company look healthy. Appraisals vary wildly from around $50 million to around $500 million.

In an interview with Antilliaans Dagblad, State Secretary Alexandra van Huffelen (Kingdom Relations) emphasized the importance of a solution for the embattled insurance company. “We want a good solution for Ennia,” she is quoted as saying. “This is necessary because next year there could be payment problems that put pensions at risk.”

Because the government of Curacao has refused to accept a 1.2 billion guilders Dutch loan to solve Ennia’s financial troubles, the country will have to pay a higher interest rate on its refinanced liquidity loans. Curacao will have to pay 5.1 percent, while St. Maarten gets its refinanced loans against 3.4 percent. MFK-Minister Charles Cooper (Traffic and Transport) considers this higher interest rate as a punishment for refusing to accept the Ennia-loan. Cooper said in Antilliaans Dagblad that this will saddle Curacao with additional annual interest-charges of 15 million guilders (around $8.4 million).

“We are going all the way against this indecent proposal,” Cooper is quoted as saying. The Netherlands has to abide by the law; just like they want us to abide by the law.”

Referring to the consensus kingdom law financial supervision (Rft), Cooper maintains that the Netherlands ought to offer a loan against the actual return on investment. In other words: an interest rate of 3.4 percent.

But Van Huffelen disagrees, saying that the Rft only regulates loans for capital investments and that the Ennia-loan does not fall under that definition.

###

Related news:

LOGIN TO READ MORE... THIS IS A PREMIUM ARTICLE. YOU NEED AT LEAST YEARLY SUBSCRIPTION TO ACCESS THIS ARTICLE.

...

Some articles or portions of articles are restricted exclusively for our registered members and paying subscribers. Please login here to read the rest of this article. If you do not already have a paid subscription, you will need to register here and pay for a subscription first in order to gain access to our website to read articles or contents that are restricted to paid subscribers. You need to buy at least a Day subscription for 75ct to gain access. Or log in first if you are already a registered paying subscriber to this website. Click here to register and support our work with a paid subscription.