Mullet Bay land worth 460 million guilders at the heart of Ennia’s pension problems

PHILIPSBURG – Over the weekend, reports reaching our news desk indicated that the Prosecutor’s Office in Curacao at the behest of the Central Bank of Curacao and St. Maarten (CBCS) requested the assistance of the Prosecutor’s Office in St. Maarten to put liens on over ten properties of Sun Resorts Ltd NV. Alarm bells went off because one of the major properties on St. Maarten owned by Sun Resorts is the Mullet Bay property. According to press reports in the past, Mullet Bay land was on the books at Ennia for a value of 460 million guilders. The property was being used as collateral for loans extended by Ennia to entities under the control of its majority shareholder and chairman of the board, Mr. Husang Ansari.

PHILIPSBURG – Over the weekend, reports reaching our news desk indicated that the Prosecutor’s Office in Curacao at the behest of the Central Bank of Curacao and St. Maarten (CBCS) requested the assistance of the Prosecutor’s Office in St. Maarten to put liens on over ten properties of Sun Resorts Ltd NV. Alarm bells went off because one of the major properties on St. Maarten owned by Sun Resorts is the Mullet Bay property. According to press reports in the past, Mullet Bay land was on the books at Ennia for a value of 460 million guilders. The property was being used as collateral for loans extended by Ennia to entities under the control of its majority shareholder and chairman of the board, Mr. Husang Ansari.

At the time, in 2015, the Central Bank issued a directive to Ennia that the Mullet Bay property must be taken off the books of Ennia and the loans the property served as collateral for be repaid in full back to the pension fund of Ennia. The potential financial risk exposure this posed for the pension payment obligations of this insurance company had become too great to ignore any longer. Three years later, with the lien placed on the property at the behest of the Central Bank, it is obvious that this directive was never followed up on.

What does this mean? And what is the issue here?

The issue is sufficient coverage of the pension payment liabilities the pension fund of Ennia must have in terms of liquid (cash) reserves in order to satisfy these liabilities when they become due in the future.

In 2016, Het Financieel Dagblad in The Netherlands reported that the pension funds of Ennia were virtually cleaned out by the owner in exchange for worthless land in Mullet Bay on St. Maarten. The land served as collateral for intercompany loans. Claims were made in the press that 70 to 77% of the pension fund was not covered with enough liquid reserves. The Ennia management vehemently denied the claims, stating that only 40% of their money was under the management of the owner via other companies that are not under the supervision or oversight of the Central Bank.

The suspicion regarding the claims made in the press that over 70% of the pensions were not covered are very likely to be founded can be derived from the actions of the Central Bank, including the filing of charges with the Prosecutor’s Office in Curacao and the subsequent actions taken to put liens on the properties of Sun Resorts Ltd NV in St. Maarten. The emergency measures instituted by The Bank are now completely in effect. The objective is to restructure the company’s finances and to secure the rights of the pension clients and other stakeholders. In a press conference last week, CBCS also indicated that one hundred million dollars of Ennia’s money had been retrieved after this amount had been illegally transferred outside the company. This latest action was the reason for the drastic measures taken by the Central Bank to assume court-approved control of the insurance company.

In the meantime, the complete management and supervisory board, including chairman Ansari himself, have been fired by the Central Bank. Even the recently announced proposed appointment of former minister of Finance of St. Maarten, Mr. Richard F. Gibson Sr., has been annulled by the CBCS. Gibson is the long time legal counsel and advisor of Ansari and handled the affairs of the latter for years on St. Maarten.

A salient point in this whole affair is the fact that several of the other properties owned by Sun Resorts Ltd NV is apparently government-owned land given out years ago in long lease for 1 Antillean Guilder cent per square meter. These lands then subsequently traded hands for thousands of US Dollars per square meter, thereby giving the sellers a 1,800,000% return on their investment. Hence, the claims that the properties owned by Sun Resorts Ltd NV and used as collateral for the Ennia pension fund loans are virtually worthless land. The land values are obviously inflated due to excessive speculation in the land prices per square meter.

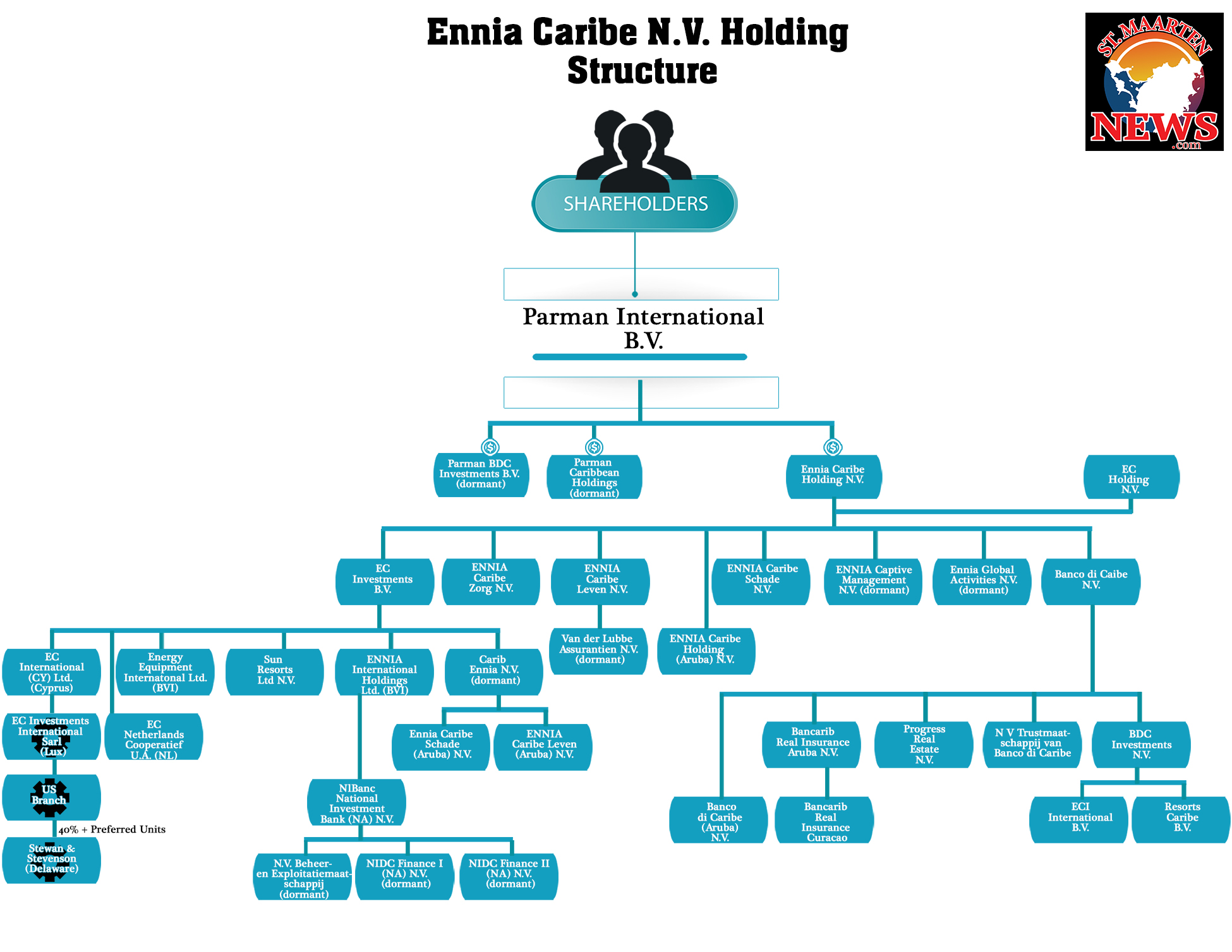

Image caption: A graphic rendition of the holding structure of the Ennia Caribe Holding N.V. company with an indication of the possible position of another holding company in the group, namely EC Holding N.V., recently discovered by the Central Bank authorities, an entity whose existence up until now went unreported by Ennia’s management and owners. The reason for this double-layering is yet unknown. Graphic rendition made based on court documents obtained by StMaartenNews.com. Click on the image to enlarge for detailed viewing.