Insurance matters

By Hilbert Haar

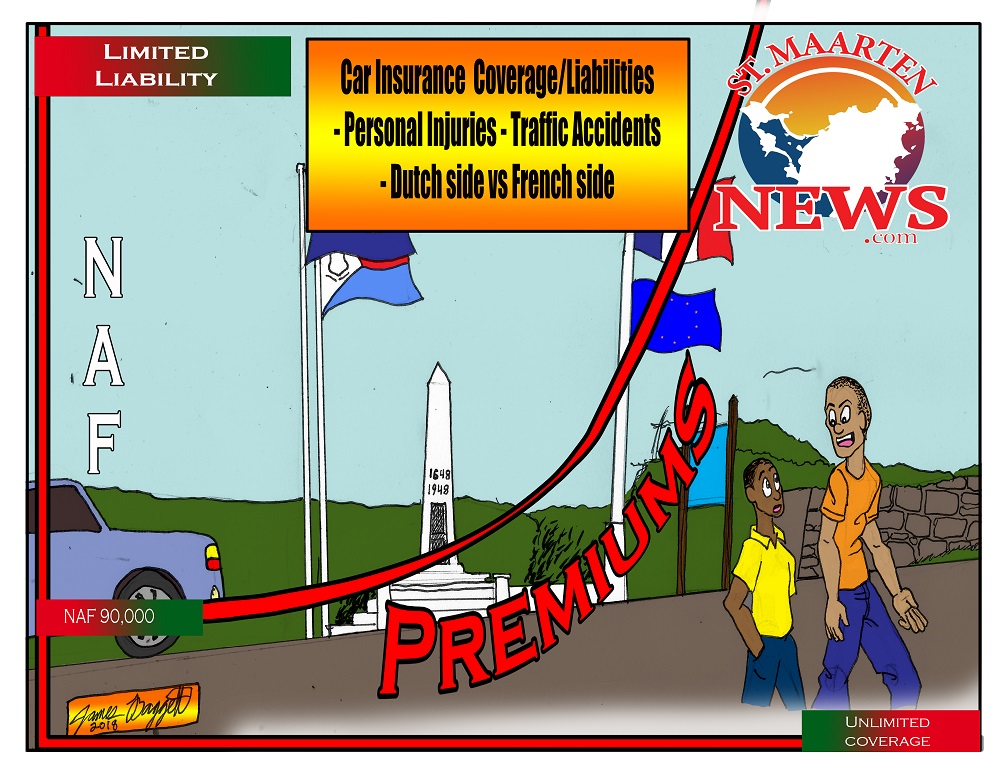

Anybody who has ever insured a car on our island on the French side knows one thing for sure: those insurances are much more expensive than the ones on the Dutch side.

The reason for this price difference is obvious. Dutch-side insurers have limited their liability to 90,000 guilders, while French side insurers are not allowed to put any limit on their liability for personal injuries their clients suffer in traffic accidents.

The limitation-clause in Dutch-side insurance policies is based on the law. The legislator has chosen to allow insurance companies to limit their liability to a measly 90,000 guilders (just over $50,000). If I understand the court ruling on this matter correctly, this limitation was actually put in place for the benefit of the insured.

The idea behind the limited liability clause was that it would allow insurance companies to charge lower premiums and that therefore more motorists would buy insurance. Half a loaf is better than no bread at all.

Several years ago, a traffic control showed that 7 percent of the hundreds of motorists the police controlled had no insurance. With, say, 25,000 cars on the road, this means that there were 1,750 people driving around without insurance. Prosecutors told me at the time that the actual number is much higher.

But now the situation in St. Maarten – two countries, one people – has bitten at least one insurance company in its behind with a ruling stating that the limited liability does not apply if a traffic accident happens on the French side.

French legislators have also made a choice to protect victims of traffic accidents: there is no limitation on the liability of insurance companies for personal injuries. That rule also applies to cars with a Dutch-side insurance.

Because Dutch-side insured cars travel to the French side all the time, insurers like Nagico are now faced with a dilemma, and possibly with a host of financial problems further down the road.

I do not know how many Dutch-side insured motorists have been involved in accidents on the French side since 2000 and how many of them had damages that exceeded 90,000 guilders. It is however not unthinkable that these motorists will pick up on the recent court ruling to claim all damages that were not compensated above 90,000 guilders. It could potentially lead to a truckload of court cases – not only against Nagico, but against all insurers on the Dutch side.

And then there is the other side of the story. How are the insurance companies going to deal with this new reality? Common sense tells me that they will adjust their policies in a hurry. They could adjust their premiums, meaning that insuring your car will become more expensive. They could also remove the 90,000-guilder liability-limit from their policies, unless their data show that most of the insurance claims are about accidents that happened on the Dutch side.

An option that probably won’t fly is to ask clients to accept the 90,000-limit as optional – on the condition that they will never drive across the border. I think that even if they accepted the limit voluntarily but still crossed the border French law will be held against the insurance companies and they will be forced to pay whatever the personal injury damages amount to.

A third possibility is that politicians will spring into action. I admit, given the dump-saga, that this is highly unlikely but somewhere somebody must realize that the limited liability clause has backfired, in spite of the good intentions the legislator had at the time of this unfortunate decision.

If the court ruling makes anything clear it is that we may live on an island, but that there is also a bigger world outside of our borders where different rules may apply. It makes no sense to close our eyes to that reality.

###

Related articles:

Limited insurance coverage invalid on the French side, court rules