Corporate Governance and The Role of The Supervisory Board of Directors (SBD)

Corporate Governance and the role of the Supervisory Board of Directors is back on the forefront with the issues surrounding the urgent dismissal of the board of the Princess Juliana International Airport Holding (PJIAH) N.V. company by the Council of Ministers of the Leona Romeo-Marlin II government on Tuesday, July 31, 2018.

In a subsequent press statement issued by the Minister of TEATT’s cabinet office on Wednesday, August 1, Stuart Johnson as the Shareholder Representative announced that “While the Council of Ministers initially decided to dismiss the Supervisory Board Members of PJIA Holding Company, with immediate effect, in further deliberations and considering all interest at hand, it amended that decision.”

The press release further elaborated that the amended decision states that “The Members of the Supervisory Board of the Holding Company are placed on notice of the intention of the Shareholder to terminate their function, as soon as possible. The Shareholder will further seek the advice of the Corporate Governance Council on this subject, forthwith. Meanwhile, the Members of the Supervisory Board of the Holding Company are placed on non-active duty for a period of up to two months, starting August 1, 2018.”

Before we address the question whether supervisory board members can be placed on non-active duty and whether such a status for supervisory board members even exist, we will discuss the role of the Supervisory Board of Directors in this article and leave the aforementioned questions to be answered by the legal minds among our readership.

For this feature length article about the Supervisory Board of Directors (SBD), we posed the following questions to several experts on Corporate Governance:

- What are the specific roles of the SBD?

- Can the SBD give the CEO instructions? Can the SBD only advise? Or give guidelines?

- Is it normal for SBD members to be in a company on a daily basis, sitting in the CEO’s office and giving the staff instructions?

- When or under what circumstances can a SBD take over the management of a company?

- Politics being what it is on a small island like St. Maarten, how do you view the role of the members of the SBD who has to ultimately answer to their political masters who appointed them to the SBD?

- When or under what circumstances can the SBD be held liable for the results of the company?

In answer to question 1 regarding the specific roles of the SBD, attention was brought to a 2009 PwC Memorandum on the Corporate Governance Code. The following are the tasks of the Supervisory Board of Directors:

A. To supervise the policy of the management.

B. To render advice to the management.

C. To appoint and dismiss members of the Managing Board.

D. To approve significant resolutions of the Managing Board.

According to Miguel Goede of the University of Governance, the “SBD has multiple roles that seem to contradict each other. They have a hierarchical role, being the one that appoints and dismisses the CEO, but at the same time they are the primary advisor of the CEO. The emphasis should be on the second role, to assist the CEO. In practice we see it is the other way around.”

In answer to question 2 whether the SBD can give the CEO instructions; or if the SBD can only advise or give give guidelines, Miguel Goede had this to say:

“The CEO is the organ who is in the driver’s seat of the company. The CEO is responsible and decides what route he is going to take. He does so based on the plans he presented and discussed with the SBD. Once the plans have been approved, the SBD monitors the execution and once a year discusses the performance of the CEO. The SBD cannot give instructions to the CEO. The CEO is accountable and can be brought for the court for his actions.”

In answer to question 3 whether it is normal for SBD members to be in a company on a daily basis, sitting in the CEO’s office and giving the staff instructions according to Miguel Goede of the University of Governance, the “SBD should meet about six times a year, including four meetings to discuss the quarterly reports. The SBD should not get involved in the daily operations of the company, however the members of the SBD can speak to everyone in the company to gather information to understand what is going on. But the SBD should not intervene with the driving. Doing that is an accident waiting to happen.”

In answer to question 4 when or under what circumstances can a SBD take over the management of a company, Miguel Goede of the University of Governance wrote “There must be strong and clear indications that the CEO is not reaching for the approved destination and is an unskilled driver for the SBD to intervene. Even so the structure of periodic meetings should be enough to guide the CEO and the organization. In my opinion, only after two or three annual cycles there is enough indication that a CEO is not performing well enough.”

In answer to question 5 on how the role of the members of the SBD is viewed if they have to ultimately answer to their political masters who appointed them to the SBD, Miguel Goede of the University of Governance writes: “It is a common misperception that members of SBD need to answer to anyone. They need not answer to politics. They are independent and service the company. Their primary concern is the continuity of the company. They are appointed based on their expertise and should be guided by the body of knowledge of their expertise.”

Follow-up questions:

- Can the members of the SBD be urgently dismissed by the Shareholder? Can such a dismissal occur without calling a Shareholders Meeting first?

- Can the members of the SBD be placed on non-active duty?

- What is the role of the Corporate Governance Council (CGC) when it comes to the dismissal of the SBD? Is an advice from the CGC required when dismissing a SBD?

It would be interesting not only to receive answers to these questions from our corporate governance experts but also from the legal minds among our readers. At the very least, it would be good input for an open discussion on this topic.

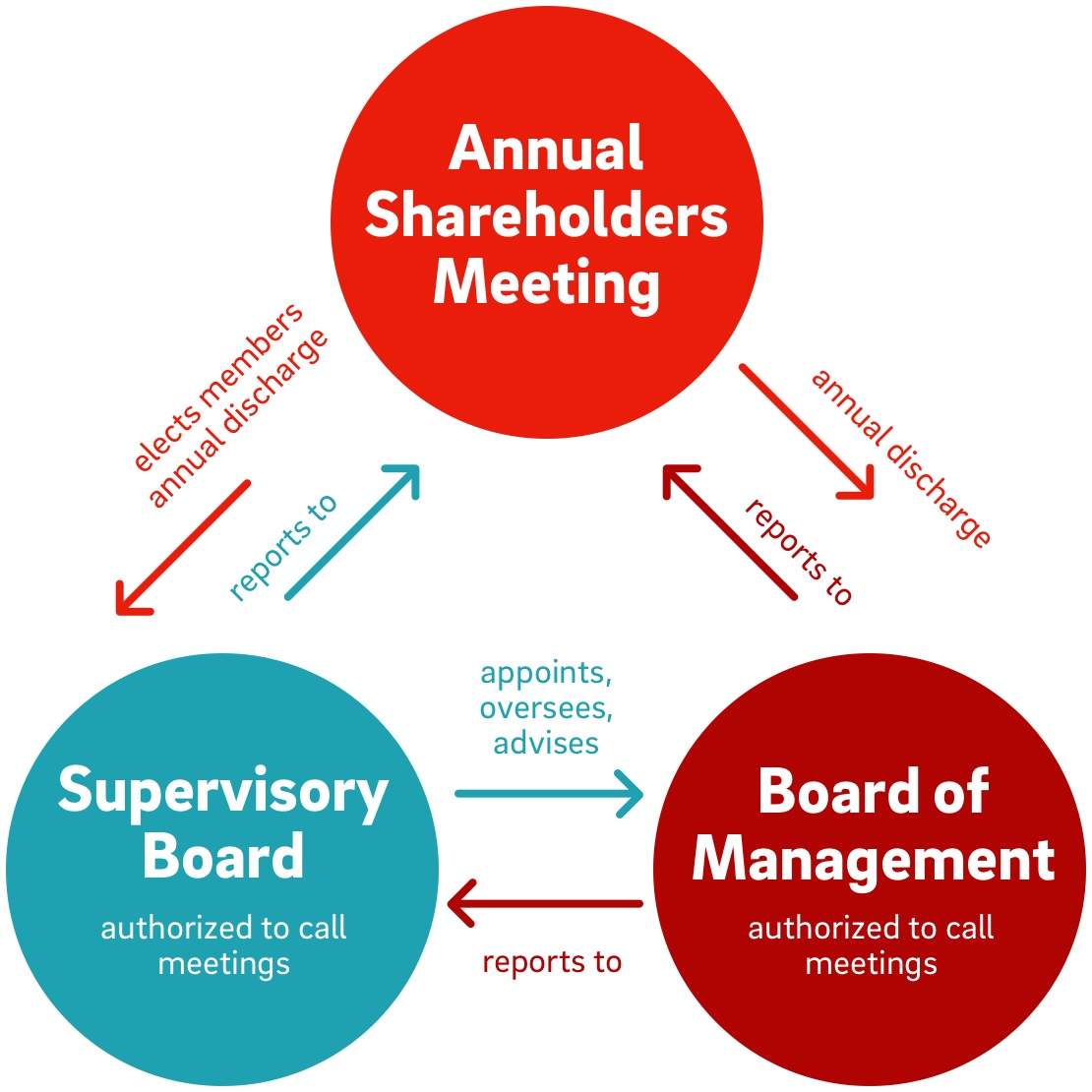

Finally, we would advocate the organizing of a seminar on corporate governance and invite the boards of all the government-owned companies, foundations and entities to attend this session as it seems to be needed based on the continuous conflicts between the three entities that form the corporate governance triangle: the Shareholder, the Supervisory Board and the Management Board (as depicted in the above graphic rendition of the relationship between these three entities).

###

Related articles:

Minister Johnson addresses urgent dismissal PJIA holding board

Editorial: Today for me, tomorrow for you