Insurance Insights: “The story of how to avoid under-insurance”

Part 1

I went down to NAGICO Insurances offices on the Cannegieter Street. Finding parking close by is always a challenge. I figured I would use The Secret to attract a parking spot right in front of the NAGICO building. I imagined that the old security guy would be holding a spot for me as I pulled up in my red Ford Escape jeep. Indeed. That is exactly what happened. He was in the process of pulling back up the lock after a client had backed out and drove away when I arrived and turned on my indicator light to indicate that I wanted to make a left turn into the vacant parking spot. He saw me as I stopped across the street and indicated that I wanted to park. He immediately lowered the barrier and stepped aside so that I could drive in and park. There was something about him that always made me feel that he was a kindhearted gentleman. I wonder how long he has been working for NAGICO? Then a funny thought popped into my mind. I am sure he knows everything about NAGICO insurance policies? Maybe he knows all the application forms backwards and forward? Maybe he studied all the fine print of every form and policy. That is exactly what I was here for actually. To fill in an Application Form.

Part 2

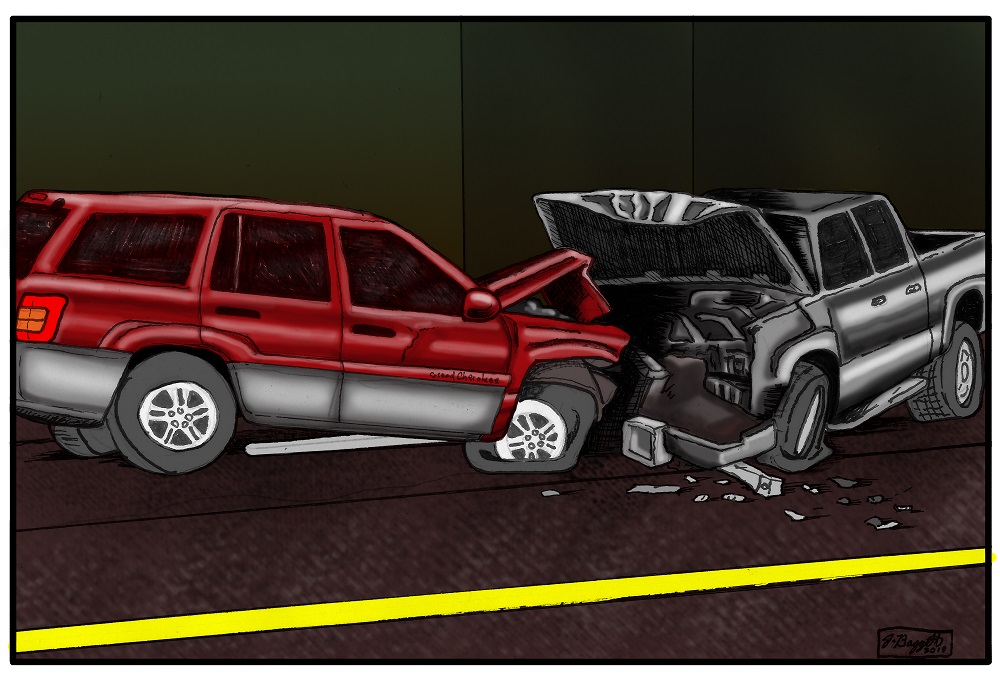

I think this was the same parking spot I used when I had made an accident on the Pondfill Road, right in front of the Yellow Building next to Carl & Son’s Bakery & Cafe. My attention was diverted for a millisecond when a rental car in front of me suddenly stopped to turn into the road in front of the Yellow Building. I think it is called the Tamarinde Steeg. I slammed the brakes as hard as I could, but it didn’t help one bit. The jeep slid and slammed into the back of the Suzuki car. There was no avoiding it. It would be my second accident since my first in December 1992 in Rotterdam, Holland. My first accident in St. Maarten. Ah, man! There goes my No Claim Discount. I had managed to drive accident-free for 10 years on St. Maarten. I immediately wonder how much the Deductible would be. I got out of my jeep and went to see if everyone in the car were okay. There were three tourists in the car. All shook up. I called NAGICO’s Roadside Assistance. There was going to be paperwork. I hate paperwork.

Part 3

Man, buying a house was a lot of work. I hate paperwork. I looked up into the sky, as if to ask the good Lord forgiveness for being ungrateful. I was able to buy a second house and I was here to see if I could expand the Endorsement of my present home insurance policy to include the second home. I planned to move to the new house and rent out the first house. The rental income was good. My real estate agent was sure he could get upwards of $850 US Dollars a month for the two bedroom house. If I was lucky, I would could even get $1000 a month. I wanted a good solid tenant though. Someone with a good job and a good income. Someone who worked for the government, or a government-owned company or a bank. Maybe even someone who worked here at NAGICO Insurances. It would have to be a woman though. Women are more financially conscientious. As a landlord, I didn’t want to have to deal with a tenant who could not pay his rent at the end of the month. Maybe I should go to the Rental Committee and have a chat with Mr. James. Maybe he could give me some good tips how to select a good tenant. I certainly don’t want to be confronted with an exclusion denying me insurance coverage because my tenant was not a good home-user. Did NAGICO require information on the tenants of the homes they insure? I would have to ask the account manager.

Part 4

As stepped out of the jeep, I turned back to grab my folder. It was marked INSURANCE and it contained the Property Appraisal Report of the house I had bought. I had also requested a new appraisal of my existing house. Unbelievable! The land alone was worth $100,000 US Dollars. Who could afford such a ridiculous price. Oh yeah, I could. But still! It was ridiculous. Maybe I should have done like my friend, Emilio, and buy a property in Belize instead. I would have certainly gotten more acres for my dollars. But then again, I didn’t really want to live in Belize.

Part 5

As I opened the office door and stepped into the air conditioned office, I nodded at the security guard on duty. Nice lady. The office was buzzing like a beehive with activity. As I glanced around, I saw other customers waiting on their turn. All the agents at the counters had a client in front of them. I spot one of NAGICO’s insurance adjusters coming out of his office in the back. He was NAGICO’S most experienced in-house Insurance Adjuster. I immediately had a flashback to our discussion one day in his office as we discussed my insurance claim. That was the day I learned that I had to bring in a yearly appraisal report to make sure my insurance coverage was up-to-date. Now I bring in an appraisal report every year instead of the recommended two to three years. I wasn’t taking any more chances. You never know when another hurricane could hit our island.

Part 6

The discussion I had with NAGICO’s Insurance Adjuster was about the dreaded Under-Insurance. I was made to know that under-insurance arose when the amount for which you have insured your property, also referred to as the Sum Insured, is less than the actual cost of reconstruction or rebuilding of that property to its original or pre-loss state.

Part 7

I made it my business to research everything about how I could avoid under-insurance in the future. Apparently, I could have avoided under-insurance all together. According to NAGICO marketing document you can avoid under-insurance by reviewing the adequacy of your sum insured with your insurance representative (agent, broker or insurer) annually. To assist with this discussion, you should consider having a professional appraiser (individual or company) assess your property on a periodic basis (e.g. every 2-3 years) and outline the reconstruction cost of your property in his/their report. In addition, should you also plan on doing renovation work and once the renovation work has been completed, you should discuss this with or inform your insurance representative.

Part 8

As I took a seat to wait on my turn, I unfolded my StMaartenNews.com newspaper and the front page had an article about NAGICO signing a new re-insurance treaty with their Reinsurer Swiss Re. From the front page photo it was apparent that this was done at sea on a boat by a company official of the European division of Swiss Re while he was on an extreme endurance ocean rowing race across the Atlantic from Europe to the Caribbean in an effort to raise $80,000 US Dollars for Multiple Sclerosis. A good effort and I immediately wondered what time of the year it was: January 2018. Well outside the Atlantic hurricane season. Good for us. And good for him. He was already half-way across the Atlantic. Good for Multiple Sclerosis as well.

Now let me see about updating my insurance policy.

The end!

###

GLOSSARY

| Questions | Answers |

| 1. What is an application form? | It is a form you fill out which provides information the insurance company will use to decide whether to issue you a policy and how much to charge. The application form is a part of your contract with the insurer. Thus it is therefore important that it is filled out as completely and accurately as possible. |

| 2. What is an endorsement? |

This is a written amendment to an existing insurance policy that changes the terms/ conditions or scope of the original policy issued. An endorsement can either expand or limit the benefits payable under the policy. |

| 3. What is the deductible / excess? |

The deductible, also referred to as excess, is the amount of money that you are responsible for paying toward each insured loss (e.g. a car accident, hurricane, fire etc.). The deductible applies each time you file a claim. Insurers usually subtract the deductible/ excess from your claim payment although you can opt to pay your deductible and receive the full claim settlement thereafter. A deductible can be a percentage of the sum insured or a specific dollar value. Ensure that you are aware of the deductible on your policy. |

| 4. What is an exclusion? |

An exclusion is a provision in an insurance policy that denies coverage for certain perils, people, property, or locations. It is important for you to understand what are the exclusions in your policy. Ensure that you discuss this with your insurance representative. |

| 5. What is underinsurance?

|

Underinsurance arises when the amount for which you have insured your property, also referred to as the sum insured, is less than the actual cost of reconstruction / rebuilding that property to its pre-loss state. |

| 6. How can clients avoid under-insurance?

|

You can avoid underinsurance by reviewing the adequacy of your sum insured with your insurance representative (agent, broker or insurer) annually. To assist with this discussion, you should consider having a professional appraiser (individual or company) assess your property on a periodic basis (e.g. every 2-3 years) and outline the reconstruction cost of your property in his/their report. In addition, should you plan on doing any renovation work and once the renovation work has been completed you should discuss with/ apprise your insurance representative. |

| 7. What is a property appraisal report?

|

A property appraisal report is a document that provides the opinion of a professional appraiser on the value of the property being assessed. Appraisals can be done to assist with making varying decisions, for example, to determine the sale price of the property or for determining the property’s insurable value. It is important that you advise your appraiser of the intended use of his/their report so that the appropriate valuation methodology is applied. The reconstruction cost is the value relevant for insurance purposes. |

| 8. What is the role of an insurance adjuster?

|

Claim adjusters, as they are commonly referred to, are trained professionals who investigate a loss (be it a fire, hurricane, motor accident etc.), assess the extent of coverage held by the insured and make recommendations on claim settlement. Adjusters are also sometimes directly involved in the negotiation of settlements with insureds on the behalf of the insurer. These claim adjusters are qualified and experienced professionals usually in varying fields: insurance, claims, construction, engineering, architecture, finance etc. Adjusters may be employees of the insurer (staff adjusters) or of independent adjusting firms (independent adjusters). |

| 9. What is NCD and how does it operate or benefit you.

|

NCD is the acronym for No Claim Discount. As the name suggests, it is a discount that is granted to the customer for not having incurred a loss (i.e. for being claims free). This type of discount is usually associated with vehicle policies. The level of NCD granted varies from insurer to insurer but, the principle is the same; the greater the claims free period the greater the discount an insured can gain, although there is usually a maximum discount that can be obtained. |

| 10. What is a reinsurer?

|

A reinsurer is a company that provides insurance to insurance companies. Reinsurance is purchased by insurers, as part of their risk management strategy, to transfer portions of the financial exposure they assume when they provide protection to individuals for their cars, homes, businesses, boats, health, life etc. |