Frontal collision: no deal about liquidity support

PHILIPSBURG / THE HAGUE – The government caused a frontal collision with the Kingdom Council of Ministers on Friday that makes it highly questionable that there will be a deal about continued liquidity support and about the refinancing of a 50 million guilders loan.

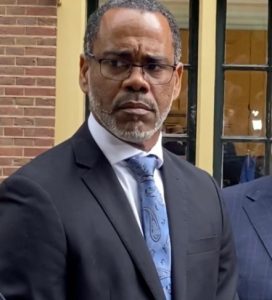

At the time of this writing that deal is off the table. We learned from impeccable sources that Minister Plenipotentiary René Violenus read a letter in the Kingdom Council of Ministers meeting that basically blames the Netherlands for St. Maarten’s current predicament.

At the time of this writing that deal is off the table. We learned from impeccable sources that Minister Plenipotentiary René Violenus read a letter in the Kingdom Council of Ministers meeting that basically blames the Netherlands for St. Maarten’s current predicament.

The Minister Plenipotentiary falls under the responsibility of Prime Minister and Minister of General Affairs Silveria Jacobs and it stands to reason that Violenus presented in the meeting what he was told to do, rather than acting on his own initiative.

The Dutch part of the Kingdom Council took offense and decided “that St. Maarten must make clear for one hundred percent that it accepts the offer for support from the Netherlands without comments and that it distances itself from the insults members of parliament directed at State Secretary Knops during last Monday’s meeting.”

Furthermore, the government must distance itself from the Pro Soualiga Foundation and its frivolous opinion that the Kingdom Charter is an illegal piece of legislation.

While the deadline for a deal expired, Prime Minister Jacobs maintained shortly before 1 p.m. local Dutch time on Friday that negotiations were still ongoing. While this may very well be true, it does not change the stance of the Netherlands: St. Maarten’s Council of Ministers has to come up with a letter to State Secretary Knops in which it distances itself unequivocally from the statement Minister Plenipotentiary Violenus presented in the Kingdom Council of Ministers, from statements made in Parliament and from the Pro Soualiga Foundation.

The deadline for these demands expires on Saturday at midnight local Dutch time – or 7 p.m. local St. Maarten time.

Jacobs was inclined to consult Parliament about the situation but time was too short for that. Sources told us that the Council of Ministers was in an emergency meeting to discuss its next step.

If no deal is reached this weekend, St. Maarten will default on a 50 million guilders loan. This in turn will have consequences for the country’s already very poor credit rating. Moody’s lowered St. Maarten’s rating in June 2019 from Baa2 to Baa3 and changed the outlook to stable from negative. All this was before the COVID-19 pandemic hit the island’s economy hard.

Combined with the political dispute with the Kingdom about liquidity support Moody’s rating is certain to drop further in the near future and that will make borrowing on international financial markets – if at all possible – even more expensive.

###

Related articles:

Opinion piece: “A very bad situation” by Hilbert Haar