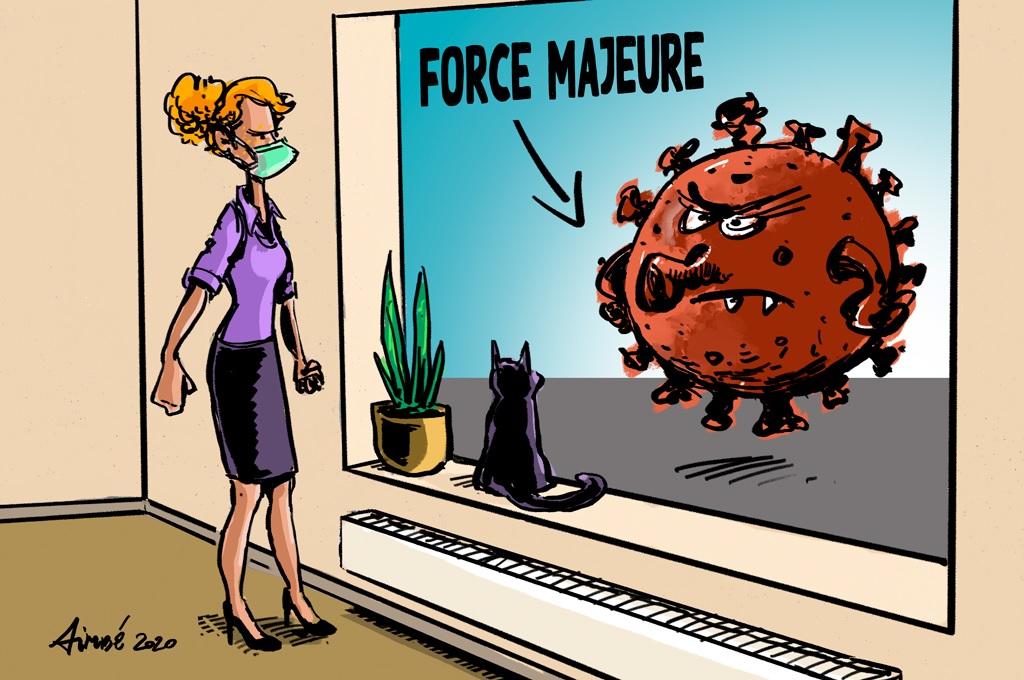

Force Majeure: The Liability Question

Our local accountant had some very interesting things to say wherein he gave us his opinions about the demands SZV was imposing on some of his clients. Companies are utilizing a loophole by filing zero for the wage tax and social premiums. It is expected that these companies also file “0” for the turnover tax over the same periods. SZV is not falling for this trick, however. According to our accountant, SZV requires companies to de-register employees that, due to the lockdown and the present economic crisis, are not being paid and to re-register those employees when things pick back up.

Under normal circumstances, such assertions would need verification with SZV. However, we do not see any accountant worth his or her salt sucking this information out of their thumbs. We are sure this is the daily reality of these professionals when dealing with the issues surrounding the SSRP, the St. Maarten Stimulus Recovery Program.

The SSRP is a relief program put in place by the government to assist businesses and employees negatively impacted by the pandemic and the resulting lockdown decreed by the government. The stimulus support comes in two forms: Payroll Support and Business Income Support.

SZV, the social insurance bank of St. Maarten, has been assigned by the minister of Finance through the minister of VSA to be the administrator of the payments to companies that qualify for the stimulus support. This assignment, that falls outside of the scope of the role of SZV, was regulated by a ministerial decree and, according to some, has no legal footing.

Related article: Force Majeure or not?

Where things get technical, in terms of the legality surrounding the enforced lockdown by the government, is the question based on which law this measure was implemented. The measure had a broad effect as the government utilized this emergency power to basically shut down the entire economy, disrupting normal business operations, stopping workers from carrying out their employment obligations and disallowing companies from being open to the public and their staff.

The question is, can this be considered ‘Force Majeure’? Under force majeure we usually understand some kind of ‘act of God‘, especially in the form of a natural disaster that would have this type of widespread interruption of business operations. Insurance does not cover this type of business interruption. One could argue that companies should have sufficient reserves in place for at least three to six months. Having reserves may be fundamental to the stability of a business operation to guarantee business continuity for a certain amount of time. It is, however, not a legal requirement and certainly not a factual requirement where it pertains to businesses on St. Maarten.

What is not debatable on our part is whether an emergency decree, that goes against the obligation of the employer to provide work and the right of an employee to earn a wage, can be used by the government as a basis to force these parties to adhere to an agreement that was, as a result of this decree, rendered null and void.

If government exercises its power – based on whatever laws it utilizes for this purpose – the government should be a reasonable partner in this exercise by also providing these parties the opportunity to reach new agreements that would be more in line with the reality of their situation. Government cannot just: 1. Force companies to shut down. 2. Force workers to not show up for work due to curfews put in place by the government. 3. Require these same companies to continue to adhere to the regular labor laws and to maintain the legal obligations towards their employees, thereby rendering the ‘no work, no pay’ rule invalid. And then simply ignore the short, mid or long-term financial consequences of these measures and decisions for both employers and employees.

For instance, the government did not put a temporary law in place, allowing companies to reduce working hours. Companies do not even have any way to reach an amendment of the labor agreement unless the employees also agree to this. Forced dismissal or dissolution of the labor agreement is then the only remedy. However, most employers and workers were willing to reach amicable side agreements for continued employment with less pay or less working hours. Moreover, creative solutions were found via the loophole of filing zero wages, taxes and social premiums. A solution to which SZV, the insurance bank and SSRP administrator, is objecting to big time.

Other loopholes are being utilized by companies to get payroll and stimulus support. Some companies have been closed to the public yet received payroll support by exploiting other activities not listed on their business license or that the turnover in the month under review is intentionally lowered or deferred, ensuring that they qualify for the full amount of the payroll support. At the same time, other active companies did not bother to request payroll support because of the administrator’s choice or because of the additional operational costs, not making the business viable beyond 2 to 3 months.

Even within the labor and social services department, interpretation of the no-work-no-pay rule during a public health crisis is unclear. Also unclear is whether COVID-19 is a ‘Force Majeure’ or an act of God. There is no jurisprudence that a pandemic on the scale of COVID-19 can be classified as such, according to a labor and social affairs department head in a recent interview.

Government cannot claim to have done all the necessary to save businesses, jobs, and maintain a viable economic infrastructure. At the end of the day, it boils down to just one question: can government be held liable for the consequences of the lockdown? Remember, insurance does not cover the business interruption as a result of this lockdown. So who can answer the liability question?

###

Related articles:

Force Majeure or not?

Peggy-Ann Dros: “Employers have to pay 100 percent salaries”